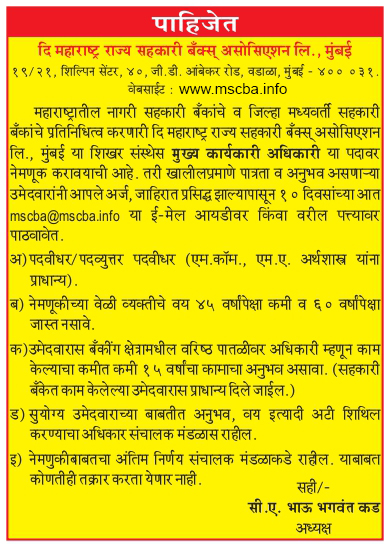

HISTORY

The Maharashtra State Co-operative Banks Association Ltd is an organization that coordinates the activities of all District Central Co-operative Banks and Urban Co-operative Banks in Maharashtra. .

Year 1939 to 1949

Although the actual work of the association began in October 1939, the work did not have the momentum it would have in the first decade. Either way, the struggle for independence was still in full swing and the boundaries of the state of Maharashtra were not definitely decided. From 1939 to 1949, the state was surrounded by Mumbai, Gujarat and the rest of Maharashtra. That period of transition proved to be a bit of a test in the decade following the creation of the association. In the year 1939, the State Co-operative Bank was functioning as a District Bank in many districts. In 1948, a policy was decided to have one district bank at each district location. This decentralization of the banking system at the district level turned out to be the right decision. District banks have proved us through their work. Hence, local deposits diverted into the district banks and the banking system reached grass roots through local economic reforms. The two committees were established in connection with the difficulties arising in the rural economy in 1945 due to the Second World War. Dr. Dhananjairao Gadgil was the chairman of one of the committees and this committee undertaken the study of problems in the supply of agricultural credit, the arrears in the supply of credit i.e. overdues and for this the restructuring in the supply of credit. Whereas the chairman of the second committee was the then president of the association Mr. RG Saraiya. The Gadgil Committee recommended that the provision of co-operative credit was not sufficient to meet the needs of the farmers, hence an "Agricultural Credit Corporation" should be set up in each state. On this the Bombay Government called for the opinion of all the co-operative workers, accordingly the Association convened a joint meeting of the Association on 14 December 1946. Dr. Gadgil, Chairman of the first committee, then Minister for Cooperation Mr. Vaikunthbhai Mehta were present in the said meeting.Mr. RG Saraiya, President of the Association said that the cooperative movement in Bombay State is strong and the Agricultural Credit Corporation is capable of fulfilling its introductory primary role. This role was inconsist with the role of the Gadgil Committee. Therefore, the government suggested setting up a committee under the chairmanship of Manilal Nanavati to study the opinion presented by the association and the opinion of the Gadgil Committee. The said committee submitted its report on 29 July 1947. This report became the ultimate guide for the policy of the cooperative sector in the post-independence period and the association's role as coordinator of the cooperative banking sector proved invaluable. At the end of the year 1946-1947, the member banks of the association included 14 District Banks and 54 Urban Co-operative Banks. A practice which has been followed since the inception of the Association is that the Chairman of the State Co-operative Bank is the ex-officio President of the Association and the Executive Director or senior officer of the State Co-operative Bank is appointed as the Honorary Secretary. By continuous advocacy one of the important task completed by the association in the decade of 1939 to 1949 was success in exempting the co-operative banks from the imposition of capital gains tax and business profit tax on banks since 1947-1948. In the year 1947, the question of determining the liquidity for District Central Co-operative Banks and Urban Banks came before the Association. The association used to give advice to the Co-operative Department regarding determining the amount of liquidity from time to time, considering the questions such as what percentage of the total payable amount should be kept as liquidity and in which format this information should be requested. Around in 1944, the association started a quarterly magazine called "Newsletter" for all co-operative member banks. From 1939 onwards, the Association started holding Co-operative Conferences as a guide for co-operative workers, keeping in view the various issues of co-operatives. In 1939, the first cooperative council was completed in the year of its establishment. During this decade, some infrastructural decisions for the cooperative sector were initiated through the Association 1. The Bombay Co-op Societies Act, 1925 - Amendment of section 12 2. The organization was not conducting the annual meeting of the organization subsequent to registration. The association has taken initiative in conducting first annual meeting within three months of the registration of the organization or within a total of six months after granting an extension of three months by the Registrar. If such meeting is not held, the registration of the organization will be automatically cancelled, under intimation to Registrar and Cooperative Act amended accordingly. 3. Co-operative Societies were not giving importance to Auditor's report after inspection of the organization. Since there was no provision in the law, no action could be taken against the Co-operative Societies. The association after study requested the government to consider the matter and amend Section 22A of the Co-operative Act. 4. The Association got approved the increase by 12 times the liability, call-up share capital, reserve fund and other funds of Central Financing Agency and Urban Co-operative banks. 5. For the growth of cooperation, permission was obtained from the government to allow one person to become a member of more that one co-operative banks have more than one organization as a member of one person. 6. From 1st January 1949 efforts were made by the association to bring down the rate of interest on short-term agricultural loans to 4 per cent. 7. Prof DR Gadgil suggested to the Banking Inquiry Committee of the Government of India appointed under the chairmanship of Sir Purshottam Thackeray that the state government should help these banks in the form of subsidy as the deposits collected in rural areas are used for the development of rural areas. 8. In 1943, the association suggested some reforms in the balance sheet of the cooperative banks and the Reserve Bank and the government approved it.

Year 1949 to 1959

During this period, our Association started functioning as a central co-ordinating body to guide the cooperative banks regarding their policies and procedures. The association effectively started the work of linking the Cooperative Accounts, Ministry of Finance, Reserve Bank and Cooperative Banks. Since its inception, the Association played the role of spokesperson of the Co-operative Banks, even when in the first 14-year Association was not registered. Finally on 10th December 1954 Mr. Chinmulgund, the then Co-operative Commissioner, registered the Association under the Bombay State Co-operative Societies Act, 1925 in the name of "Bombay State Co-op Banks Association Ltd". The following rules were set as per the bye-laws of the association. 1. Co-ordinating the work of District Co-operative Banks and Urban Co-operative Banks in the State and advising on banking. 2. To audit banks which are not under the member banks audit federation. 3. To Communicate with Agricultural Credit Department, Money Market Department of Reserve Bank of India and to provide necessary required information to member banks through periodicals. 4. Implementation of mutual arrangement scheme for Urban cooperative banks etc Area of operation:- As per the by-laws then prevalent, the area of operation of the association was restricted up to the state of Mumbai. In 1956, the state was restructured. Four districts of Mysore state and the Marathwada and Vidarbha sections were included in the area of operation. Later on, 1 May 1960, the Mumbai-linguistic state was divided and two states namely Gujarat and Maharashtra came into existence. Gujarat State Co-op Banks Association was established in the state of Gujarat. The above incidents affected adversely and there were constant changes in the membership of the association. In the year 1957-59, the Association started the work of Voluntary Inspection to monitor the working of Urban Co-operative Banks. During the period of 1957 to 1959, Association examined 15 Urban banks and gave valuable advice to 2 urban banks how to get out of their difficulties. The association followed up with the government and the Reserve Bank from time to time and got the Surat District Central Co-operative Bank permission to do foreign transactions. The standard parameters were set for Central Financial Agency and got approved by the Government. In connection with the election of the Board of Directors of the District Central Co-operative Banks, some important suggestions were made and the approval of the Government was obtained.

Year 1959 to 1969

The first meeting of the association was held on October 5, 1939. Padmashri RG Saraiyya became the first Chairman of the association. For twenty years from 1939 to 1959, he held the post of Chairman very efficiently. During the said period, he discussed with the state government and cooperative Department on important strategic issues and forced the government to take the right decision. Prof. D. G. Karve successor of Shri. R.G. Saraiyya was the Chairman till May 1960. Later, Dr. Dhananjairao Gadgil became the Chairman and he was the Chairman of the association until 1967, till he was appointed as the vice-president of the Central Planning Board. After Dr. Dhananjairao Gadgil, till 1969 Shri Vasantdada Patil was the Chairman of the association. It can be said that the decade from 1959 to 1969 was a important decisive decade for the association. On May 1, 1960, the bilingual state of Bombay was divided into two states namely Gujarat and Maharashtra. With this division 12 District Banks and 24 Urban Co-operative Banks have gone to Gujarat and Association had to pay 18,827/- to the Gujarat State Co-operative Banks Association. Bombay State Co-operative Banks Association Ltd was renamed as 'The Maharashtra State Co-operative Banks Association Ltd' from 1st July, 1962. In the Union Budget of 1960-1961, the income limit for availing income tax exemption was brought down to Rs.10,000/- for co-operative societies. Co-operative societies were exempted from paying income tax on their profits when the association pleaded. On October 11, 1964, the Association celebrated its Silver Jubilee. On March 1, 1966, Urban cooperative banks were brought under the ambit of the Banking Regulation Act, 1949, an important historical event. Hence it was accepted that Urban cooperative banks are an important component in the banking business of the country. From 1939 to 1964, the office of the association was located in the premises of Maharashtra State Co-op. Bank Ltd. building. In 1964, the office of the association was shifted to "Jahgir Building" and after that it was shifted in the premises branch of the Maharashtra State Co-op. Bank Ltd. In the year 1965, one of the saddest events in the history of the Association took place, the sudden death of Shri. Vaikunthbhai Mehta. Due to this incident, one of the brightest stars in the constellation of the Indian Co-operative Movement was dislodged. Irreparable damage was done. In the year 1967, due to the new section "194A" of the Income Tax Act, the banks were to be adversely affected. The association effectively presented its case against this clause on behalf of the co-operative banks. When the association started functioning in October 1939, it was not even registered. The Chairman of the Maharashtra State Co-op. Bank Ltd. is the President of the Association and the ex-officio President of the Executive Committee is the tradition that started at that time and continues till date. The Government and RBI used to take policy decisions regarding cooperative banks in consultation with the association. The association has also delivered the proper advice from time to time in the interest of the banks. The merger of weak urban co-op. banks with the big sound banks without going in liquidation were carried out only by coordinating with each other among the state co-op. banks, associations, cooperative Department and the Reserve Bank of India.

Year 1969 to 1979

The year 1969 became a milestone in the history of Indian economics. The Indian banking revolution started in this year. The area of operations, no of transaction and size of the banks were growing at a great rate. The central government decided on a definite policy in this regard and on July 1969, declared nationalisation of 14 major commercial banks. The nationalisation of 14 major commercial banks resulted in increase in financial assistance to SSI, Agriculture This was welcome move in the direction of national growth / interest To spread and popularise the banking amongst Middle and Poor class of community, Urban Co-operative banks held lion’s share right from the establishments of UCBs till 1959. During the said period commercial banks were owned by few traders / merchants groups and banking used to be availed with these banks by small and rich traders. After nationalisation in 1969, these 14 commercial banks were opened for general public. The Saraiya Committee was established in the year 1972. This committee highly appreciated the progress of urban cooperative banks and recommended that some progressive banks should be given "Schedule" status on certain criteria. But it took another 16 years to implement this recommendation. On December 20, 1974, a committee was appointed under the chairmanship of Mr. VM Joglekar to make a thorough study of the Urban Co-operative Banks in Maharashtra. The main recommendations were as follows – 1. To prepare model bye-laws for urban cooperative banks. Later, Madhavdas Committee prepared Ideal by-laws based on the Model by-laws. 2. Maharashtra State Co-operative Bank should take the initiative to open new banks at the district level to remove the imbalance of urban co-operative banks in the state of Maharashtra. Likewise, the sound and comparatively of big size banks to open branches in other districts and hand over these branches to these districts as Nagari Sahakari Bank. The Madhavdas Committee report helped a lot to spread the network of urban cooperative banks all over Maharashtra. On 28th April, 1977, the amendment of sub-rules passed by the Annual Joint Board Meeting was forwarded to the Commissioner Cooperative, Pune for approval. The said sub-rules amendment case was approved in April 1979 and the following important amendments were made in it. 1. The Chairman of the Urban Co-operative Bank Board shall remain as the Vice-Chairman of the Association. 2. Representation was given to each district by making a radical change in the manner of elections to the Urban Co-op. Bank Board. However, for the underdeveloped areas like Marathwada, Vidarbha, where the number of urban co-op. banks in the district is less, so divisions were created by merging the adjoining districts. In the history of the association, due to this amendment, Mr. B.H. Patil Budihalkar Veerashaiv Co-op Bank Ltd., Kolhapur got the honour to be appointed as a Vice Chairman of the association. In 1978, the Madhavdas Committee was formed to study the urban cooperative banks in depth. This committee decided the criteria of competent and incompetent banks. Similarly, the criteria for granting licenses to urban banks were decided. Due to inflation during the period 1978 to 1986, bank’s deposits, loans and other transactions increased. The criteria drawn up by the Madhavdas Committee had to be changed back. During this entire decade (1969 to 1979) the study of cooperative banks was done by the expert committee and it helped to strengthen the cooperative sector furthermore. In all these movements, Association had discharged its role of friend and supporter perfectly.

Year 1979 to 1989

The association, which was established with the view that a co-ordinating body should be needed to streamline the functioning of co-operative banks, celebrated its golden jubilee in this decade. The Association's Mutual Arrangement Scheme has also completed 50 years. The association continuously assisted the co-operative banks to overcome their difficulties. In the convention held at Karad in 1975, the seeds were sown to establish an independent apex bank, state and district level association/federation for urban cooperative banks. The State Co-operative Bank and the Association did not seriously consider this matter. The conference expressed the feeling that since State Co-operative Banks are ignoring the problems of Urban Co-operative Banks which is a main cause for setting up a new Shikhar (Apex) Bank. Nonetheless, a committee of 5 experts was formed under the chairmanship of Mr. Navneet Barshikar. If the State Co-operative Bank and the Association had taken up this matter seriously, the Maharashtra State Urban Co-operative Bank Federation and the new State Shikhar (Apex) Bank would not have been formed. As a result of this, Maharashtra State Urban Bank Federation was established on 9 March 1979. This new federation led to the division of the co-operative banking system into urban co-operative banking and district central co-operative banking and widened the earlier gap between district central co-operative banks and urban co-operative banks. The association was put into grave loss due to separation of Association in two Units. During this decade (1979-1989) the association organized three state level conferences. The first conference at Osmanabad was held on 3rd and 4th November 1979, the second conference at Nanded on 7th and 8th June 1987 and the third conference was held at Mahad on 2nd and 3rd January 1988. These conferences provided a forum for the member banks to present their problems to everyone. So the government officials present at this conference helped to understand the problems of cooperative banks.

Year 1989 to 1999

Maharashtra State Co-operative Banks Association was established with the objective of providing a platform to the District Central Banks and Urban Co-operative Banks in Maharashtra to discuss their queries and problems and to take effective measures thereon. The decade from 1989 to 1999 was a turning point for the cooperative banking sector in many ways. Whether it was the beginning of radical changes in banking regulation, or increased competition, or the introduction of a new computerized system, it all happened in this decade. The co-operative sector also faced a dilemma due to the establishment of the new apex bank and the establishment of the Urban Co-operative Banks Federation. But Vishnu Anna Patil, the then President of State Co-operative Bank, very skillfully understood all the situation and toured Maharashtra to further study the needs on Co-operative Banking. One of the decisions he took in the matter of association was far-reaching. The Managing Director of State Co-op. Bank Ltd was acting as the Honorary Secretary of the Association. The responsibility of the day-to-day matters was given to the full-time secretary. There was no speed in the work as the full-time secretary did not have the authority. The member co-operative banks were not getting any direct benefit from it, Hence, they gave the freedom consent to work as full-time secretaries of the association. The work of the association was accelerated during this period by opening the rooms by allowing full time secretary. The direct result was that the dependent association moved towards financial self-sufficiency within a few days. Until then, the association was getting only fees from member banks and interest on deposits. The association now had a wider role to play. It was now natural to adopt a new policy of providing special services at discounted rates to member banks. It is from that to prepare a proposal to establish a new urban cooperative bank. In this, through the association, proposals were prepared for the establishment of banks namely Parivartan Urban Co-op Bank Ltd., Mumbai, Laxmikrupa Sahakari Bank Ltd., Pune, Gadchiroli Nagari Sahakari Bank Ltd., Gadchiroli, Malad Sahakari Bank Ltd., Mumbai and they were approved by the Reserve Bank and the Government. There were many complaints of urban cooperative banks regarding the functioning of Maharashtra State Co-operative Bank and its impact was reflected in the Council of Urban Banks held at Parbhani. The then President Mr. Vishnu Anna Patil held a meeting of the officers of the State Co-op. Bank Ltd and the officer of Association and in year 1995 appointed a committee consisting of Mr. M. G. Suratwala, the officer of the State Co-op. Bank and Dr. V. Y. Tarale, the Secretary of the Association. This committee redressed the complaints of the banks to the Banking Department of the State Co-op. Bank Ltd. The provision of deduction of tax at source on deposit interest of co-operative banks was introduced from 1st July, 1995. Government of India and Reserve Bank were requested to cancel it. Similarly, efforts were made to reduce the stamp duty levied on urban cooperative banks. Emphasis was placed on the facilities of designing training programs for the employees, officers and directors of the banks. This proved to be a golden opportunity for banks as private individuals were charged less fees than institutions. The training program conducted by the association became more profitable for the banks due to the method of providing training in different parts of Maharashtra and in the banks themselves. The Cooperative Commissioner's office also took proper notice of this and gave official status to the association's training certificate. The association's certificate was accepted for promotion to the employees. In 1993, for the first time, the association organized a meeting in Mumbai under the guidance of Mr. Ramania, Chief Officer, Reserve Bank of India, to provide information about Foreign Exchange Business to the Urban Co-operative Banks. For Urban cooperative banks this was were very useful. Meanwhile, the association got representation for the first time in the Reserve Bank's State Level Requirement Committee. Therefore, the Reserve Bank began to understand the proper situation of cooperative banks. The first study tour in the history of the Association was also conducted by the Director of the Association in the state of Gujarat. The purpose of this visit was to bring together the Directors of the Association to exchange ideas and also to visit the District and Urban Co-operative Banks of Gujarat State to study their functioning. In order to know the problems of District Central Co-operative Banks and Urban Co-operative Banks, the Association decided to hold department wise meeting for the first time and the first meeting was held at Ratnagiri District Central Bank on 16th May 1995. After this, meetings were held at Sangli, Pune, Parbhani, Nashik and the association learned about the problems of the banks. An award scheme was started in the year 1996 to promote the performance of District Central Co-operative Banks and Urban Co-operative Banks. Under the said scheme distribution of awards have been started. The first award ceremony was held in Mumbai Mr. P Ramania, General Manager, Urban Bank Department, Reserve Bank of India was present as the Chief Guest. The computer era had begun in co-operative banks. A State Level Computer Conference was organized by the Association on 9.4.1997 to inform the Cooperative Banks about this subject. The conference was inaugurated by Mr. Parmar, Chief General Manager, Reserve Bank of India while Mr. Vishnu Anna Patil was the Chairman. The number of Women Urban Cooperative Banks in Maharashtra is remarkable. The first conference of these banks was held in Nashik in 1999. Mr. Manmohan Singh Rekhrao, Chief Manager of Urban Bank Division of Reserve Bank was present as the Chairman of the Council.

Year 1999 to Till Date

The association progressed with the acceptance of transitions with times. Thinking ahead of the time, the association started an independent division MSCB Infotech and under this division the association provides the banks in various subjects like computer system audit, IT policy, IT related, HR policy, core banking technology, staff recruitment and promotion planning and started providing services. In 2005, the association launched a study center. Yashwantrao Chavan also stepped in the field of education by starting Co-operative Management courses in collaboration with Maharashtra Open University. Along with this, Indian Institute of Banking and Finance has also appointed the association as their official study center. The Association has set up a Research and Planning Department for the more in-depth study of the Co-operative Banking sector. Till date, 12 students have completed Ph.D. from this research center. Until now the association was always carrying out its work within the framework of the State Co-operative Bank but today the scope of the organization has increased and financial capability has also improved. Considering all the above, the Association entered into its own office on 6th September, 2005. In the year 2003 - 2004, the annual general meeting of the association was initiated by inviting experts from the cooperative sector or financial sector to provide guidance to the attendees. This year famous economist Shri Girish Vasudev was invited. In the year 2006-2007, the association started a plan to adopt weak banks. Banks under this scheme were helped to get out of trouble by providing training and guidance through the association. In this year, the association also started printing the check books required by the cooperative banks. In 2007, the Association acted as a special consultant for the approval of ISO 9001-2008 Quality Management System Certification for Urban and District Banks of Maharashtra by the British Standard Institution, London, under the scheme Urban Bank, so that the Co-operative Banks do not lag behind in terms of international quality. And District Co-operative Bank got ISO 9001-2008 nomination. This year cooperative banks have been tasked with accepting PAN card applications. U.T. I. Technology Ltd., made available through Hayanche. In the year 2010, the association created the innovative scheme 'MAZA COMPUTER' and tried to bring the modern mantra of 'Cooperation to Technology' from home to home. International companies like Intel, HP and HCL participated in this scheme. This scheme was inaugurated by former Chief Minister Mr. Ashokrao Chavan at Nanded. Corrections in Sub Bye- Laws – Year 2011 Urban Co-operative bank’s Vice Chairman is named as Executive Chairman. The Change in constitution as per S. 97, restricts the total number of Directors to 21. Likewise from District Central Co-op. Bank, one member is appointed as Vice-Chairman. Doing business was never the core of the association nor was it the business policy. But financial self-reliance is equally important. Therefore, the business has increased a lot, then the income should also increase. The association, which had an income of 3 lakhs at one time, has now reached 1 crore. Now the journey of the association is on track from traditional banking to modern banking. Maharashtra State Co-operative Banks’ Association is committed to new challenges by utilizing the Chatusutri (full achievement) of training, research, guidance, modern technology.

Our Jouney

Established

1939

100 Banks

1960

Expand North Maharashtra

1980

1st Banking Awards